Today (27th August 2025) is no ordinary trading day. On one hand, the US has doubled tariffs on Indian exports, sparking global tension. On the other, Dalal Street is shut for Ganesh Chaturthi. And in the middle of all this, India is witnessing a record IPO rush.

Let’s break it down 👇

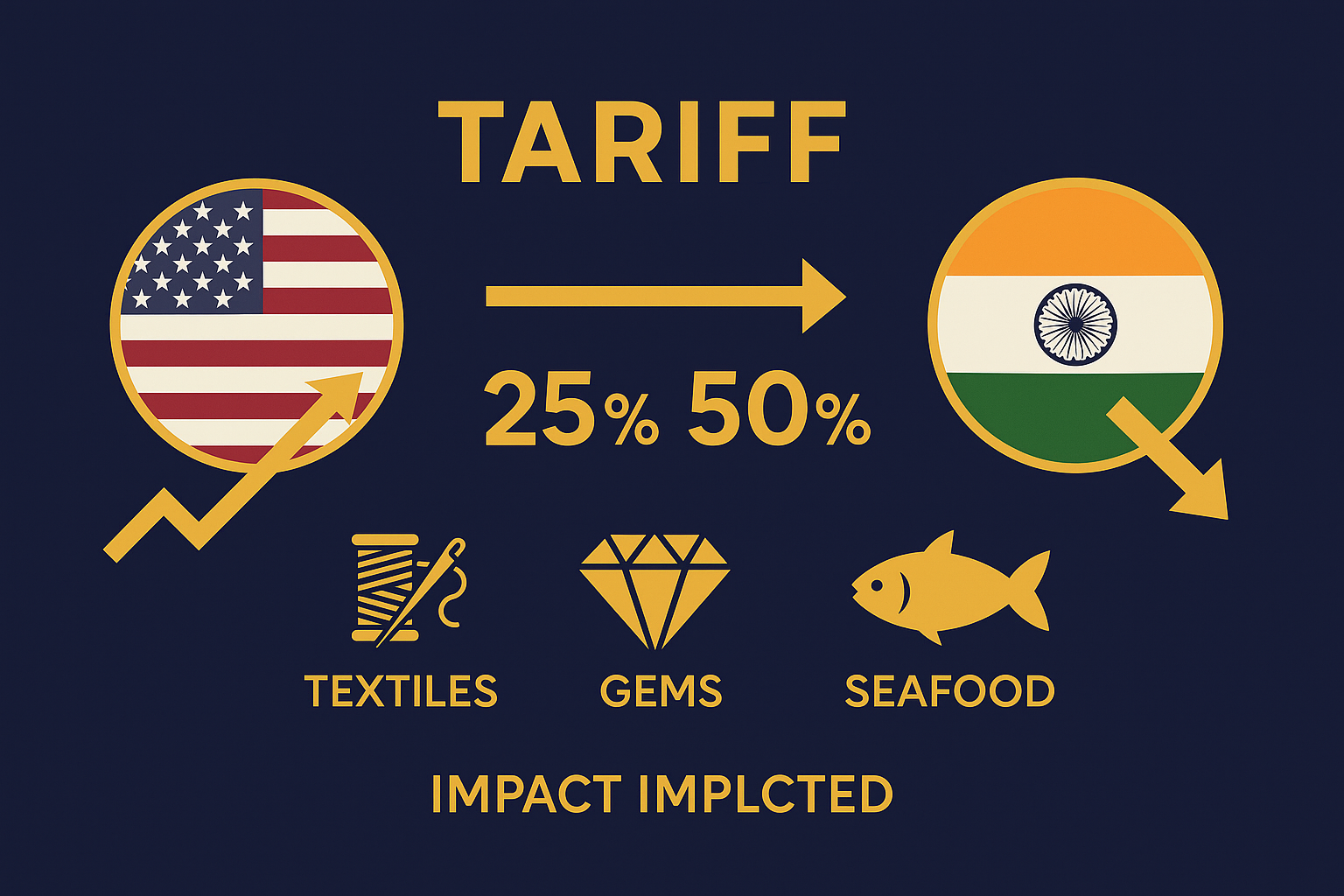

🇺🇸 US Tariffs Jump to 50% — A Big Blow for Indian Exporters

The US just raised tariffs on Indian exports from 25% to 50%.

Reason? India continues to buy discounted Russian oil, something the US doesn’t like.

Impact? Sectors like textiles, gems & jewellery, seafood, and furniture are staring at serious pressure.

📉 Market reaction:

Even before the holiday, Indian indices slipped. Sensex fell ~1%, and Nifty dropped about 255 points as investors braced for pain in export-heavy companies.

👉 Example: Textile companies already saw foreign orders slowing down, and gems exporters in Surat are worried about losing US buyers.

📊 The “Triple Test” for Indian Markets Tomorrow

When markets reopen tomorrow (Aug 28), they’ll face three big stress tests at once:

Fresh US tariffs – weighing on exporters.

Derivatives expiry – usually brings heavy volatility.

FII pressure – foreign investors may sell off if global risk sentiment worsens.

That’s like a triple combo punch 🥊 — so expect choppiness in trading.

🙏 Ganesh Chaturthi Holiday = Calm Before the Storm

Today both BSE & NSE are closed for Ganesh Chaturthi.

Commodity markets like MCX will resume evening session, but equities are fully shut.

Investors get a “pause day” to think before reacting tomorrow.

Fun fact 👉 This is the second stock market holiday in August (the first was Independence Day).

🚀 IPO Boom: 40 Listings in August!

While the secondary market looks shaky, the primary market is red-hot 🔥.

40 IPOs hit Dalal Street in August alone.

Big names like Tata Capital are creating massive buzz.

This shows that despite short-term volatility, long-term investor appetite remains strong.

💡 Why it matters?

IPO momentum is a sign of confidence in India’s growth story, even when global headwinds hit.

📌 Key Takeaways for Investors

Short-term caution: Export stocks (textiles, gems, seafood) may stay under pressure.

Watch expiry moves: Derivatives expiry + FII selling could trigger volatility.

Long-term optimism: IPOs and domestic demand continue to show resilience.

Stay calm: Festivals like Ganesh Chaturthi are a reminder—markets pause, but growth stories don’t.

📅 Today’s Market Snapshot

| Factor | Insight |

|---|---|

| US Tariffs | Raised to 50%, hitting Indian exporters hard |

| Market Status | BSE & NSE closed (Ganesh Chaturthi) |

| Tomorrow’s Risks | Tariffs + derivatives expiry + FII flows |

| IPO Action | 40 IPOs in August; Tata Capital the highlight |

✅ Conclusion

Today is a reminder of how geopolitics, domestic festivals, and market cycles all collide to shape investor sentiment. While the US tariffs are a real risk, India’s IPO rush shows confidence in the bigger picture.

Investors should avoid knee-jerk reactions tomorrow and instead focus on long-term fundamentals.

⚠️ Disclaimer

TBF Capitals is not a SEBI-registered investment adviser. This blog is for educational and informational purposes only and does not provide stock recommendations or financial advice.