Not long ago, India wasn’t on anyone’s radar when it came to global SaaS innovation. Today, it is rewriting the rules.” From powering customer support systems for Fortune 500s to building critical API infrastructure used by developers worldwide, Indian startups are leading a software revolution.

In 2025 alone, Indian SaaS startups generated more than $12 billion in revenue, up from just $1 billion in 2015. And this is only the beginning. With projections pointing to $50 billion in revenue by 2030, India is poised to own nearly 10% of the global SaaS market.

🧑💻What is SaaS ecosystem all about?

SaaS (Software as a Service) ecosystem refers to the entire network of companies, infrastructure, users, investors, and enabling policies that together create, distribute, and use cloud-based software applications delivered over the internet. Unlike traditional software (installed on a computer), SaaS runs on the cloud — users simply subscribe and access the service online (e.g., Gmail, Zoho Mail, Salesforce, Canva).

🇮🇳 India’s SaaS Ecosystem

- Over 1,600+ SaaS startups in India.

- $12–13 billion Annual Recurring Revenue (ARR) in 2022.

- Leaders include Zoho, Freshworks, Chargebee, Postman.

- Supported by strong IT talent, lower development costs, and policy push for digitalisation.

- A SaaS ecosystem is not just a single product but a self-sustaining digital economy built around cloud software. For a country like India, it represents a strategic opportunity to build global tech leaders while driving domestic digital transformation.

Think of it like an “industrial ecosystem” — but instead of factories, it’s built on code, cloud, and customers.

✅ Key Factors Driving the SaaS Boom in India 👇

1. Cost Disruption: Zoho’s Edge over Global giants

Google’s suite is powerful, but it comes with enterprise-level pricing and complexity. Zoho, in contrast, offers affordable, flexible, and deeply integrated business applications—from CRM to HR, accounting, and email—all built in India.

- Lower development and operational costs give Zoho a competitive edge in pricing without compromising quality.

- Its model fits perfectly with SMBs (small and medium businesses) worldwide that want enterprise-grade tech without enterprise costs.

- This cost arbitrage is a key factor attracting investors to India’s SaaS landscape.

2. Talent & Innovation: India’s Secret Weapon

Unlike many global SaaS companies that struggle with high engineering costs, Indian firms like Zoho leverage a massive domestic talent pool.

- Over 1 million engineering graduates annually feed into the SaaS sector, many specialising in cloud, AI, and automation.

- Zoho’s unique approach—training fresh talent in-house through its Zoho Schools of Learning that creates a sustainable, skilled workforce.

- This homegrown innovation model helps keep costs low and speed high.

📌 Contrast: Google invests billions in R&D in Silicon Valley. Zoho does the same at a fraction of the cost in Tamil Nadu, proving innovation doesn’t need a Silicon Valley zip code.

3. Global Demand for Cloud Solutions: A Perfect Storm

The post-pandemic digital shift has fueled unprecedented demand for SaaS solutions. Businesses everywhere are moving away from on-premise software to cloud-first models that are accessible, secure, and scalable.

- While Google targets large enterprises, Zoho is winning over mid-market and SMB segments, a market worth over $1.5 trillion globally.

- Data privacy and localisation are added advantages that make Zoho particularly attractive in privacy-conscious regions like the EU.

📌 Example: Zoho has grown its global user base past 100 million, making it one of the largest SaaS platforms outside the U.S.

4. Investor Confidence and Policy Push

Between 2015 and 2023, Indian SaaS companies attracted over $10 billion in funding, with Zoho’s success inspiring a new generation of startups like Freshworks, Chargebee, and Innovator.

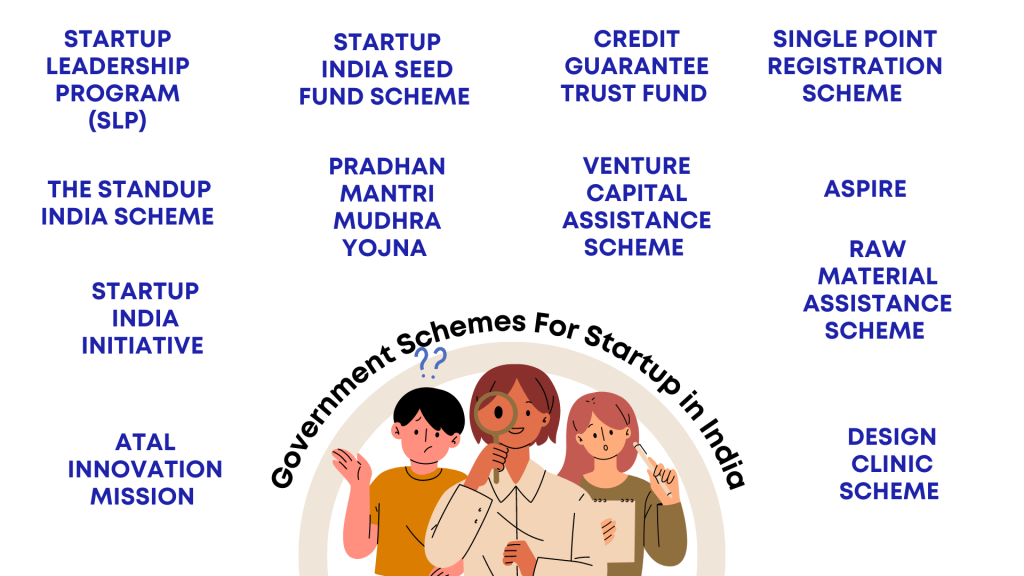

- India’s Startup India, Digital India, and ease of doing business reforms have made it easier to build and scale globally.

- Unlike heavily VC-backed Silicon Valley firms, Zoho has grown profitably and debt-free, setting a new playbook for sustainable SaaS.

5. Data Sovereignty and Privacy Advantage

- A growing demand for data sovereignty and privacy-first solutions aligns perfectly with Zoho’s “Swadeshi” ethos.

- Indian SaaS companies are leveraging this to provide trustworthy, locally rooted alternatives to global giants.

- This approach resonates strongly in markets where digital independence is a priority.

Key Government Initiatives Supporting SaaS in India 👇

- National Policy on Software Products (NPSP) 2019

👉🏻Established by MeitY, the initiative envisions India as a global hub for software product development. It encompasses various initiatives such as the Software Products Development Fund, incubator support, intellectual property incentives, and the establishment of an Indian Software Product Registry.

- MeitY’s Startup & Incubation Programs + TIDE + NGIS

👉🏻MeitY provides comprehensive support to startup acceleration through various programs. These programs encompass SAMRIDH —which focuses on product innovation, development, and growth; TIDE— which facilitates the incubation and development of entrepreneurs; and NGIS— which offers a Next Generation Incubation Scheme

👉🏻MeitY’s initiatives cater to early-stage SaaS and product startups, providing them with incubation, mentorship, technological infrastructure, and growth support.

- Challenge / Incentive Schemes (e.g., CHUNAUTI 2.0)

👉🏻Governments implement challenge-based programs for software companies to develop solutions in sectors such as SaaS, Finance, Education, and others. These programs often prioritise women-led startups. Governments provide direct research and development (R&D) support, product building assistance, and recognition to early customers.

- Swadeshi & Data Sovereignty Push

👉🏻Promotes domestic SaaS adoption over global platforms; Creates market demand for Indian SaaS; possible preferential procurement; aligns with policy & public sentiment.

- Credit Guarantee Scheme for Startups (CGSS)

👉🏻Provides loan guarantees up to ₹20 crore per startup to improve access to debt financing. Helps startups access debt financing without needing heavy collateral; mitigates risk for lenders.

India’s SaaS sector is evolving from a service-driven model to a global product innovation hub, leveraging its strong talent base, cost advantage, and privacy-first approach. The rise of companies like Zoho and Freshworks signals India’s ability to compete directly with global tech giants, offering affordable, scalable, and secure solutions for diverse markets.

“With accelerating cloud adoption and policy support, India is positioned not just to join the global SaaS race but to shape its future, setting new benchmarks in innovation and digital leadership.”

Article By :- Charu Shandil (Research & Media Associate – TBF Capitals)